Cool Info About How To Reduce Or Eliminate Debt

_1.jpg?ext=.jpg)

Paying off large chunks of your debt within a few months could save you a significant amount of money on interest payments alone.

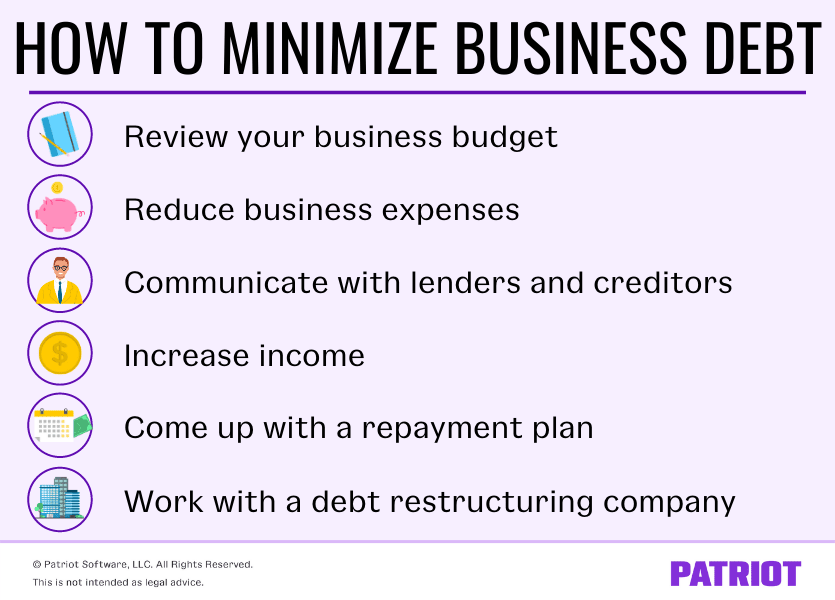

How to reduce or eliminate debt. If you're going to aggressively reduce your debt, you're going to need to free up some additional money. Find a lender & consolidate your debt today. Even when you are steady, paying those monthly bills can be such an arduous task.

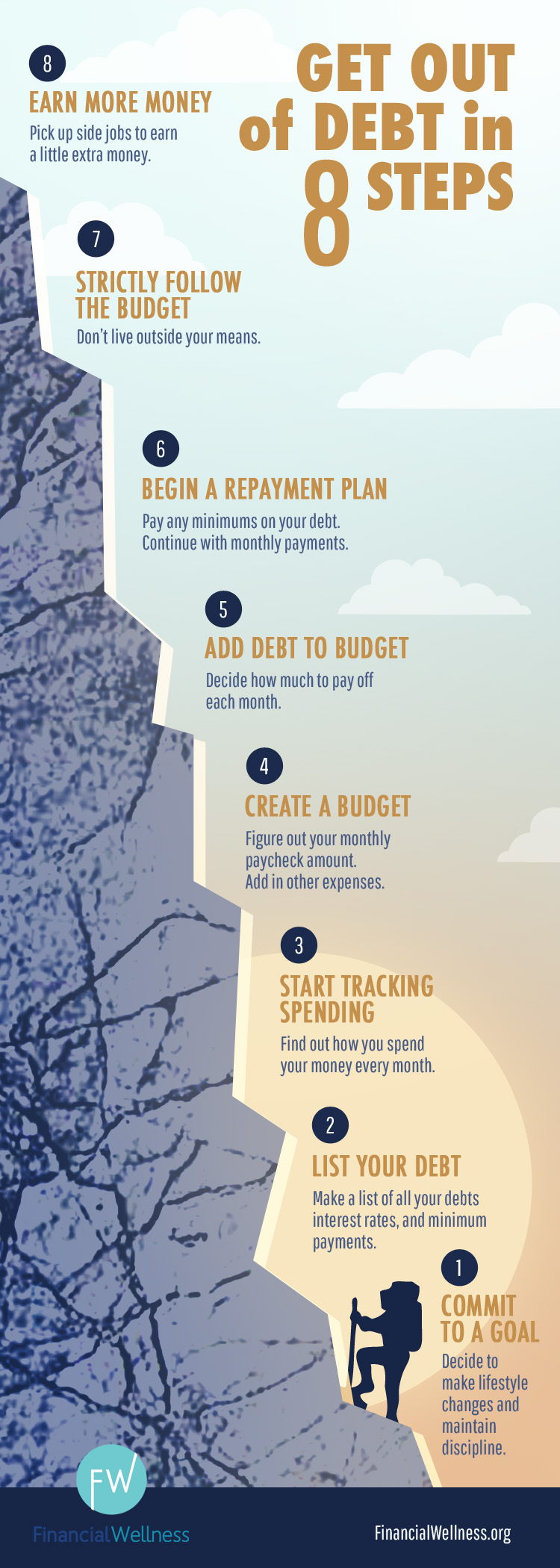

2 make a list of your current debts, including credit cards, student loans, medical debt and auto loans in order from the. Write down your monthly budget (using bank statements during this process will help. One way to do this is with the debt avalanche method:

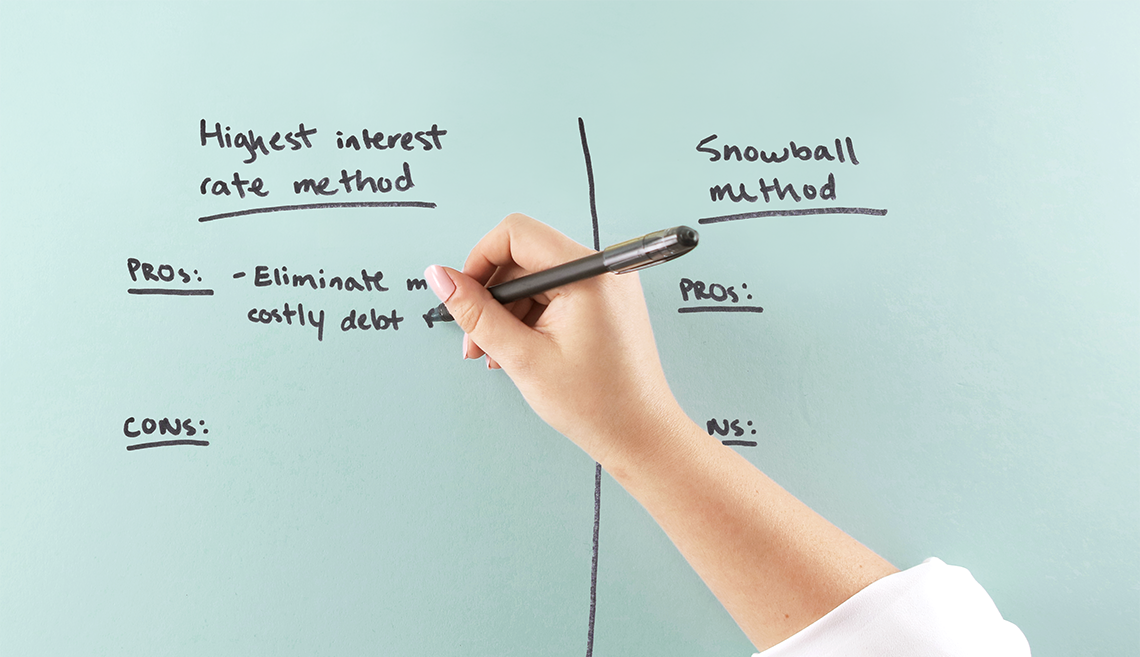

There are two basic strategies to reduce your debt: Once you have your budget, it’s time to decide how to eliminate debt from your life. Compare offers for your best rate and lowest monthly payment.

Use savings to pay down larger debts don't be afraid to. No upfront fees & no obligation. Amidst mortgages, student loans, car loans, medical bills and credit cards, it is quite easy to fall into a.

The first step is to get a clear picture of your financial situation; In his 1790 report, hamilton proposed a sinking fund to retire the public debt by issuing 6% bonds to replace older bonds issued by the states and the federal government. You must be able to spend your money wisely if you want to learn how to eliminate debt once and for all.

Consolidating your debt can be an effective way to reduce your monthly payments, as can paying off your most expensive debt first. The highest interest rate method and the snowball method. Manage and reduce your spending.

/GettyImages-1093086154-058134c8013c4dba80e8fbd13289c7ab.jpg)