Build A Tips About How To Avoid Prepayment Penalty

Say you have a loan with a prepayment penalty, and you don’t want to wait to pay it off.

How to avoid prepayment penalty. Find how to figure and pay estimated taxes. You can avoid prepayment penalties altogether if you select loans that have no prepayment penalties. The best way to avoid a prepayment penalty is to read your contract — or better yet, have a professional (like an attorney or cpa) who understands the terminology, review it.

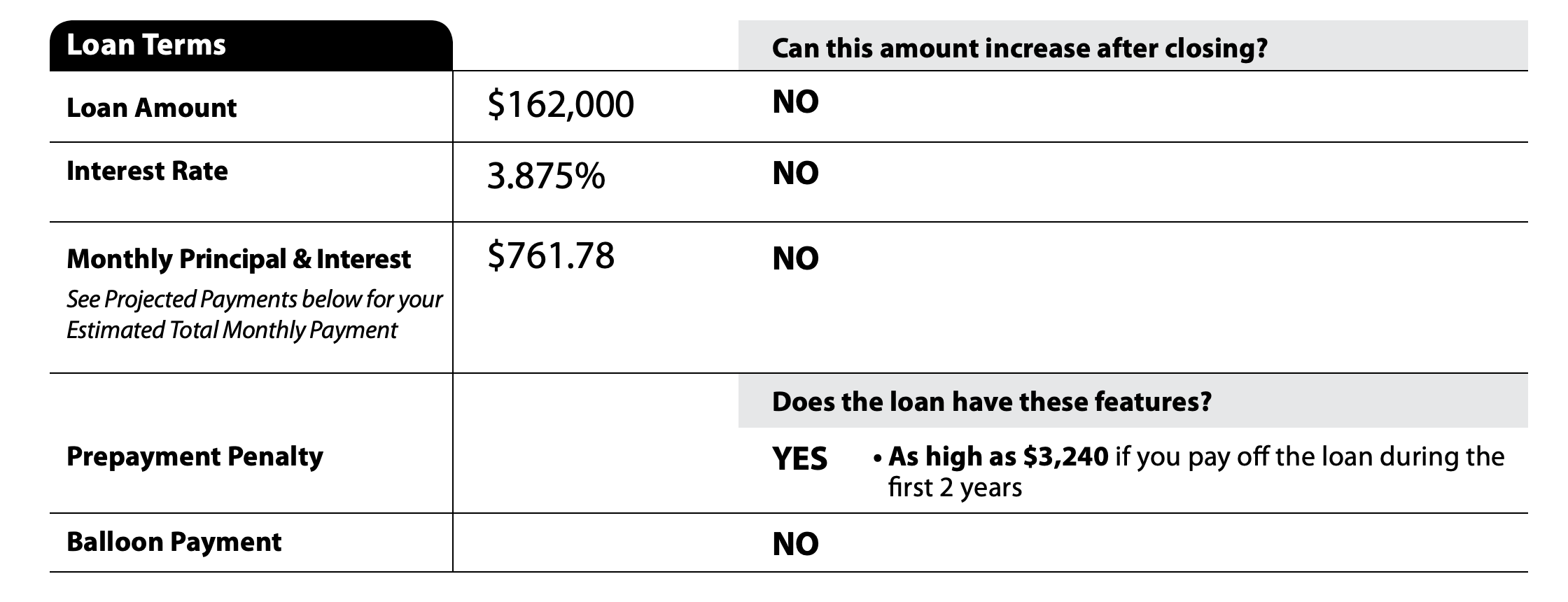

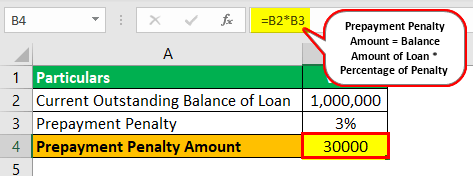

A lender might also set a flat prepayment penalty amount upfront — say 2% of the original loan amount — and that penalty would remain the same for the entire period. The best way to avoid paying an early payoff penalty is to select a lender that doesn’t charge you for paying off your loan early. Instead of appreciating that you pay your debts off early, bad credit loans with prepayment penalties charge you a fee for robbing the lender of interest rate profits.

The first thing that the borrowers should do is avoid alternative lenders. To avoid a penalty, pay your correct estimated taxes on time. The law requires mortgage lenders to disclose prepayment penalties along with other fees and loan details.

A flat fee based on when you choose to close the loan; How are prepayment penalties calculated? In other cases, some borrowers who prompt the penalty fee just pay it partially per month until the penalty date passes.

There are several ways to avoid prepayment penalties when you are getting a loan. Here are a few tips to help avoid these hefty fees. Ways to avoid prepayment penalties.

Inform your lender and wait for them to update your statement. If you’re in the market for a mortgage, an fha loan may fit the bill. In this instance, there are actually several approaches you can take to both avoid a.